Turbulent Waters in the Suez Canal, Panama Canal and South China Sea Touch Nearly 40% of Global Trade

Inflation’s declining. So, supply chain leaders can turn their attention elsewhere, right?

Think again. True, the Federal Reserve expects inflation to drop this year and next.

But remember, in this world, disruption is the new normal. A pandemic, lockdowns, trade wars, shooting wars, greedflation and political-trade turmoil have rocked the last few years.

Do you think 2024 will escape? Unlikely.

In fact, we expect transportation costs to rise faster than inflation. Container prices have already doubled from post-pandemic lows. Capacity is tightening.

Cargo ships are sailing around the entire continent of Africa to avoid missile and drone attacks in the Red Sea. They’re paying extra to jump lines in the drought-stricken Panama Canal. Or they’re waiting. And war could be on the horizon in a number of key geographic areas, including the South China Sea. (Nearly 40% of global trade passes through the Suez Canal, the Panama Canal or the South China Sea.)

Beyond higher costs, expect longer delivery times, which diminishes supply chain resiliency.

For the rest of this year and beyond, supply chain leaders and the C-suite must work hard to reduce costs and increase revenue. Your core investments should be in technology implementation and staff development.

The right partners can help.

Fed Holds Rates Steady, But Mentions No Plans for Cuts

Inflation affects your business’ performance and profitability.

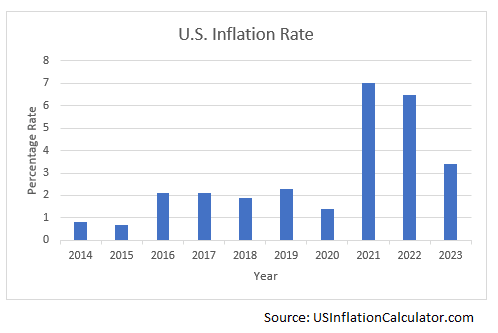

The 2023 inflation rate of 7% hit a peak not seen since the previous century. The COVID-19 pandemic, expansionary fiscal and monetary policies, shutdowns and supply and demand imbalances all played their part.

Since then, rates have declined: 6.5% in 2022, 3.4% last year. The Federal Reserve Bank of St. Louis’ Personal Consumption Expenditures index predicts further declines: 2.35% this year and 2.1% in 2025.

Consumers and businesses alike will welcome lower inflation. But the projected rates are still higher than the Federal Reserve’s long-term target of 2%.

That leaves policy watchers all over the place when predicting what the Fed will do with interest rates, according to CBS News. Leave them be? Cut them? Increase them?

As of this week, the Fed held rates steady but mentioned no plans for cuts.

Higher interest rates make borrowing more expensive for businesses and consumers. That dampens economic activity and growth. Higher rates also could mean less investment in diversifying supplier bases, which is key to your future.

You need a solid ROI for those necessary investments in technology application and staff development. That means you need partners you trust.

Other factors beyond inflation will challenge supply chains and global trade even more.

Geopolitical tensions and conflicts have disrupted global transportation and logistics networks, which are essential for moving goods and services across the world.

Panama and Suez: A Double Shot of Supply Chain Disruption

In “normal” times, about 12% of annual global trade passes through the Suez Canal. About 6% passes through the Panama Canal.

These vital waterways have been under pressure.

Starting late last year, Houthi rebels in Yemen have been firing drones and missiles at cargo ships in the Red Sea.

Numerous shippers are avoiding the area altogether, the BBC reported. That adds 3,500 nautical miles and up to $1 million worth of extra fuel to those trips. Shipping lines need more cargo vessels to deliver the same amount of goods. Ships that risk transiting the Red Sea to go through Suez must pay expensive war risk insurance premiums, according to The New York Times.

The Panama Canal crisis started sooner. The 2023 drought was the worst in a century, but droughts have become more frequent in recent years. Each transit needs 52 million gallons of fresh water.

Panama Canal administrators placed restrictions on cargo ship transits in 1957, 1961, 1965, 1977, 1982 and 1998, with the last three associated with El Niño events.

In 2023, canal authorities have made two changes: limiting the number of transits and tightening drafts. Ships that sit higher in the water must reduce their loads, sometimes by as much as 40%. Some unload cargo on one side of the canal, carry it by rail to the other side and reload it onto the ship.

The twin canal hits are increasing shipping costs and delays. That pushes operating costs up beyond normal inflation, further putting a squeeze on corporate profitability.

South China Sea: The Next Global Trade Catastrophe?

The continuing Russia/Ukraine War has affected energy prices, food and fertilizer supplies and more. Some of that disruption has been mitigated.

But beyond the fighting in Russia-Ukraine and Israel-Gaza (the Houthis cite Israel-Gaza as the reason they are attacking Red Sea shipping), war clouds are gathering in other key geographic regions.

The most rigorous analyses to date concluded that $3.37 trillion worth of trade passed through the South China Sea in 2016. That’s about 21% of all global trade.

Various nations, including nuclear, global trade and military powerhouse China, claim parts or all of that body of water.

China has even constructed a manmade island in the vital trade route and built military outposts on rocks and islets. Faceoffs between Chinese and Filipino military forces have increased.

In response, Vietnam and The Philippines recently signed a deal to enhance military cooperation in the region.

Just north of the South China Sea lies Taiwan. China views self-ruled Taiwan as a breakaway province that will eventually reunite with China. China has not ruled out using force.

So, we have a global trade hot spot with military ships and planes from various countries jockeying for control. Let’s hope no one fires the first shot.

Even a short conflict would be disastrous for trade and security in the Asia-Pacific region and the world.

A World of Global Supply Chain Risk

The picture painted above is full of risk, uncertainty and potential for additional global supply chain disruptions.

Higher transportation costs, longer delivery times, lower reliability and lower quality can reduce your competitiveness and profitability. After all, nearly 40% of global trade passes through either the two canals or the South China Sea.

And as I’ve noted many times, your business is not safe if you source, say, appliances from South America or machinery from Europe. Components for most products pass through those global hot spots.

The Only Answer? Reduce Costs, Increase Profitable Revenue

Therefore, corporate executives must work hard to reduce costs and increase profitable revenue to survive and thrive in this challenging environment. Applying the right technology and developing the right staff can reduce costs.

The right technology can help businesses improve supply chain operational efficiency, enhance visibility and transparency and mitigate risks and vulnerabilities. The right supply chain leadership program can help businesses retain and attract talent, foster innovation and creativity, and improve performance and culture.

That kind of staff can help you increase revenue by introducing new products and services, increasing customer satisfaction or entering new markets.

New products and services can differentiate your business from your competition, meet your customers’ changing needs and preferences, and create new sources of income and value.

Increasing customer satisfaction can help you build loyalty and trust, reduce churn and complaints, and generate positive word-of-mouth and referrals.

Entering new markets can help you expand your customer base and diversify revenue streams.

Combined, you have a pathway to competitive advantage.

The Right Partners Can Help You Navigate Waves of Disruption

So where do you go? At 21% (the South China Sea), 12% (the Suez Canal) and 6% (the Panama Canal), turbulent waters touch nearly 40% of all global trade.

I’d suggest finding the right partners. That’s the path Tompkins Ventures has followed since we formed the company nearly four years ago.

I would love to help your enterprise find the right fit in partners, the right people to navigate this crazy world of permanent disruption. The right enterprises to help develop your supply chain leadership development program.

Let’s talk about how we can overcome these challenges together.

Related Reading

The Panama Canal: Yet Another Supply Chain Problem

Another Case Study in Supply Chain Disruption

The China Decoupling Might Hit Before You Are Ready

How 5Ls Make a Western Hemisphere Logistics Hub

Jim Tompkins, Chairman and founder of Tompkins Ventures and Tompkins Solutions, is an international authority on designing and implementing end-to-end supply chains. Over five decades, he has designed countless industrial facilities and supply chain solutions, enhancing the growth of numerous companies. Jim earned his B.S., M.S. and Ph.D. in Industrial Engineering from Purdue University.

Excelt info

Jim, excellent info and perspective!

Its like you read my mind You appear to know so much about this like you wrote the book in it or something I think that you can do with a few pics to drive the message home a little bit but other than that this is fantastic blog A great read Ill certainly be back