The Game that Keeps Changing the Rules for Business and Geopolitics

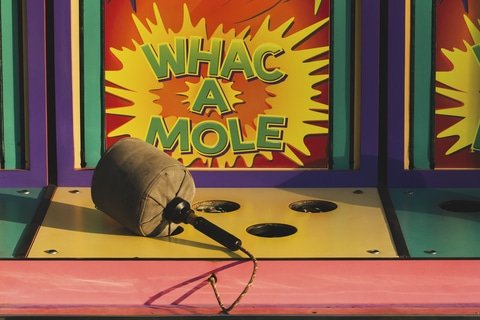

Digging into tariff implications on economics, inflation, supply chains and geopolitics reminds me of Whac-A-Mole.

Those who played the arcade game know the drill. A mole pops up in one hole, you slam it down, and two more pop up somewhere else. No matter how fast you swing the mallet, you can’t keep up.

That’s exactly how it feels reading analyses about tariffs. I’ll dive into one report that says tariffs will drag growth to near-recession levels. Then another economist pops up with a completely different projection: booming growth. Another report details how some companies are thriving.

And sometimes, I’ve seen the same institution publish two conflicting reports.

Figuring out future geopolitical relations yields similar confusion.

It’s economic and geopolitical Whac-A-Mole.

But the more I researched, the more I concluded that one economist isn’t necessarily right and the others wrong. They all have a different perspective. They’re just looking at different holes on the board, examining data from the viewpoint of the mallet or even making projections from the view of the mole in the hole.

The game changes depending on whether you view the economy from a macro (big picture) or micro (industry-level) perspective. It also changes depending on whether you’re looking at the short term or the long term.

And, depending upon your industry, you could be looking at things from the perspective of the mallet or the perspective of the mole.

Once you break it down that way, the chaos starts to make sense. Let me walk you through what analysts think tariffs mean for GDP growth, inflation and corporate profits. Then, we’ll step back and see where this global contest is headed.

GDP Growth Depends on Which Mole Pops Up

Projections for GDP growth range from a sluggish 1% all the way to an impressive 5%. That spread is massive. But if you separate the forecasts into macro/micro and short-term/long-term views, the picture clears.

- Macro, short term: This is the most pessimistic view. When economists add everything up and look at the next year, growth barely reaches 1-1.5%. That borders on stagflation.

- Macro, long term: Extend the horizon, and the numbers improve. Growth forecasts rise to 2.5-3%.

- Micro, short term: Here we find optimism – particularly in fast-moving industries like artificial intelligence, green energy and logistics. Those sectors show growth above 4%.

- Micro, long term: This is where the real upside lies. Companies that invest in innovation, intelligent capital spending and supply chain flexibility could drive growth above 5%.

So, while the headlines may highlight doom and gloom, a deeper look into tariff implications shows innovation-driven sectors pulling the economy forward, especially over the long term.

The Inflation Mole Likely Won’t Stay Up for Long

Another hot-button issue is whether tariffs will fuel inflation. Again, the forecasts vary widely, but they start to make sense once you separate perspectives.

- Macro, short term: Some price spikes will occur, but economists don’t see sustained inflation across the economy.

- Macro, long term: Same story – tariffs aren’t expected to drive long-term inflation.

- Micro, short term: This is where we do see moderate inflation. If a company imports heavily from tariff-targeted countries, some of those costs will be passed on to consumers.

- Micro, long term: Supply chain reconfiguration comes into play here. As companies diversify sourcing, invest domestically and increase resilience, tariff-driven inflation pressures fade away.

The bottom line here is that tariff implications may pinch some sectors in the short run. But over time, businesses adapt.

Profits Depend – Are You the Mallet or the Mole?

Finally, let’s discuss corporate profits. Again, everything depends on perspective.

- Macro, short term: Not encouraging. Higher wages and interest rates put pressure on margins, and profits dip.

- Macro, long term: Here, analysts vary. Many expect margin compression, while others say companies that innovate and invest wisely can expand margins.

- Micro, short term: Many firms are managing the environment by cutting costs and delaying capital expenditures. Some are meeting profit targets despite headwinds.

- Micro, long term: Profitability again depends on execution – talent retention, investment strategy and supply chain optionality will determine winners and losers.

So, are profits going up or down? The answer is yes – depending on your time horizon and industry focus.

But over time, businesses that adapt will survive and thrive. In a way, they will be left holding the mallet. Others will scramble to hide in their holes. Tariff implications cut many ways.

From Arcade Game to Global Chessboard

Stepping back from the numbers, we’re seeing a global economic realignment among trade partners. We’re moving toward a “two-systems” world:

- On one side: the Americas, Europe, Japan and South Korea

- On the other: the BRICS+ nations (Brazil, Russia, India, China and others)

On paper, the Americas bloc holds a clear economic advantage – its combined GDP is roughly double that of BRICS+. That means BRICS nations need access to Western markets more than the other way around. But that doesn’t mean the transition will be smooth.

China faces structural challenges: an aging population, a real estate bubble and continued reliance on exports. Russia’s economy remains fragile, heavily dependent on oil revenues and drained by sanctions and the war in Ukraine. Both nations face headwinds that limit their leverage.

India, however, is the wild card. So far, it has pursued what it calls a “multi-alignment” strategy. India wants to work with both blocs while positioning itself as a global bridge builder.

That approach has served it well, but pressures are mounting. Tariffs and trade restrictions could eventually force India to choose sides.

If India maintains neutrality, the tug-of-war between blocs will drag on. If it leans toward the Americas bloc, the balance of power shifts decisively. And if that happens, Russia’s economic fragility and China’s vulnerabilities could bring BRICS+ to the negotiating table.

The Bottom Line: Adapt, Innovate or Hide in the Hole

So, where does all this end? No one can say with certainty. But here’s what we do know:

- Higher tariffs create short-term disruptions but also long-term opportunities.

- Innovation, capital investment and supply chain optionality separate winners from losers.

- The global economy is restructuring around two blocs, and the role of India may determine how long the standoff lasts.

From my perspective, tariffs aren’t just an economic lever the Trump administration is using to combat U.S. trade deficits. Tariff implications reshape the structure of international trade. We’re entering a period where companies and nations that adapt with innovation and flexibility will thrive. On the other hand, those that cling to old models will struggle.

It’s a fascinating time to watch – and an even more important time to prepare. Do you want your company to be left holding the mallet or scurrying into a hole?

Related Reading

- How Regionalization Can Be as Profitable as Globalization

- From 1 Factory for the World to the World Is Your Factory

- Dynamic Optionality Beats Expanding Your Supply Chain House

Jim Tompkins, Chairman and founder of Tompkins Ventures and Tompkins Solutions, is an international authority on designing and implementing end-to-end supply chains. Over five decades, he has designed countless industrial facilities and supply chain solutions, enhancing the growth of numerous companies. Jim earned his B.S., M.S. and Ph.D. in Industrial Engineering from Purdue University.