Why Tariffs – and Optionality – Must Be on Everyone’s Radar

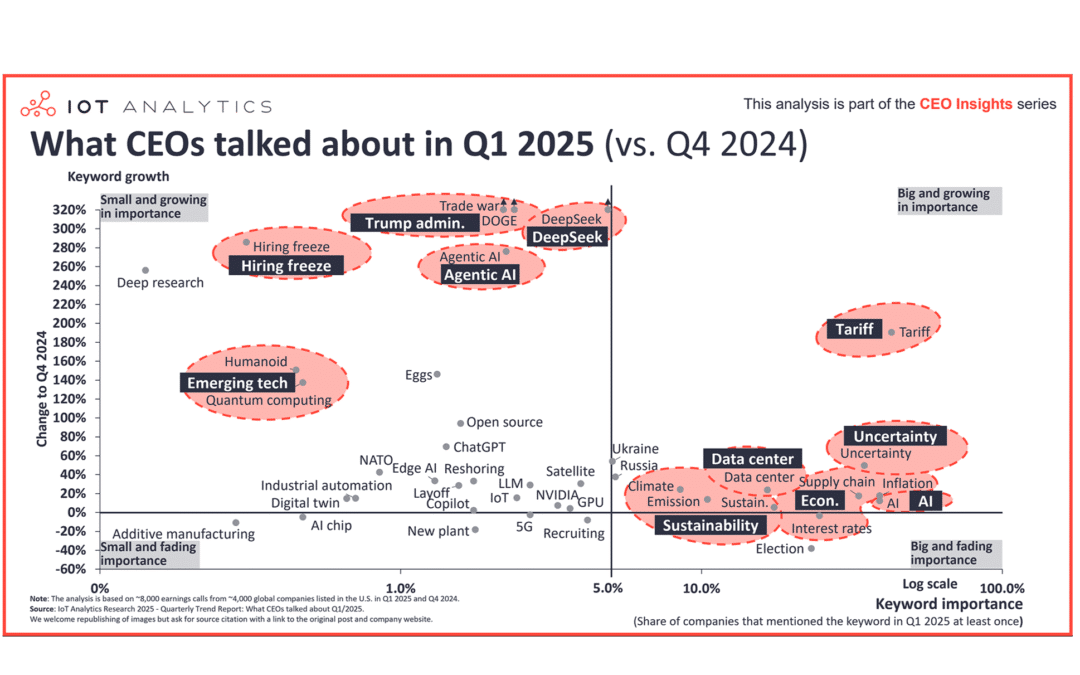

If you’ve been paying attention to CEO earnings calls in 2025, you’ve probably noticed a few familiar themes: tariffs, uncertainty and AI – especially agentic AI.

That’s what IOT Analytics reports. And my weekly conversations with CEOs and supply chain pros often cover the same topics.

But my first reaction? What took them so long?

We’ve been living in a world of VUCA – volatility, uncertainty, complexity and ambiguity – for years. I’ve been talking about this since before COVID-19. While the media debated “the new normal” for years, I said there isn’t one. The only thing we can count on is disruption.

And tariffs? They’re just the latest symptom of a long and growing list of disruptions. Automation, eCommerce, cloud migration, Trump’s first-term tariff wave, the gig economy, natural disasters, COVID-19. You name it.

Yet only 43% of corporate earnings calls in Q1 2025 mentioned tariffs. And that’s an increase of 190% from the previous quarter.

That’s astonishingly low.

Especially when you consider the simple fact that we’ve been here before. The Trump tariff era never really ended after his first term from 2017-2021.

As you can see from this Politico report, Biden kept most of Trump’s tariffs. In some cases, particularly with China, he expanded them. So why CEOs are only now waking up to tariffs is beyond me.

Maybe they thought tariffs were temporary. Or politically driven. Or someone else’s problem.

Whatever the reason, the reality is that if your supply chain still depends on a single country, or worse, a single supplier, your company is playing with fire.

Tariffs Will Change – but Disruption Won’t Stop

I expect the current tariff volatility to settle by the fall. But that doesn’t mean smooth sailing.

Because as soon as one wave calms, another swells. That’s the world we live in. And it’s why your company must prioritize optionality.

IOT Analytics cites a great example from Rockwell Inc., which is reconfiguring its supply network.

The company produces products in Mexico that are sold in the U.S. while producing similar products in the U.S. for export. So, Rockwell is moving production for non-U.S. customers outside the U.S. to create capacity to produce for U.S. customers within the U.S.

That’s a mouthful, but it’s a smart move. But let’s not confuse this with a long-term solution. What Rockwell is doing is tactical.

You also need strategic optionality – a flexible, dynamic global network that can adjust to whatever comes next: new tariffs, wars, weather events, labor disputes, pandemics, political changes. That’s what we call ReGlobalization.

Yes, Optionality Costs More. Or Does It?

ReGlobalization is not the end of globalization. It’s the evolution of it. It’s selecting from the right menu of nearshoring, reshoring and friendshoring. It’s about building a resilient, regionally balanced supply chain that gives you multiple paths to serve your customers despite disruption.

That’s the path toward optionality, and the path toward success

Many CEOs, including some in the IOT Analytics report, claim uncertainty makes long-term planning difficult.

That’s true, and I understand the frustration. But you don’t get clarity by waiting. You get it by scenario planning, by preparing options, by being ready to move when you see a clear path and by preparing to change that path when necessary.

And sometimes, that policy turns out to be a bargain. Nearshoring, for instance, reduces transportation costs and accelerates inventory turns. When the final tariff landscape is known, optionality might actually lower your total delivered cost.

Even if it doesn’t? You’ll still be better off than competitors stuck in reactive mode, facing a tariff spike with no optionality.

Waste Not, Win More – before Your Next Earnings Call

At Tompkins Ventures, we estimate that most global supply chains carry 10–15% waste. Tariffs don’t cause that. But they expose it. By tightening your network, adding optionality and leaning into ReGlobalization, you can eliminate much of that inefficiency – and gain strategic advantage in the process.

So, what now?

Ask yourself three questions:

- What percentage of my supply chain is vulnerable to tariffs?

- What options do I have to pivot if something changes?

- How fast can I act when it does?

If you don’t like your answers, we should talk. My team and I are ready to help you build optionality and turn this tariff-driven chaos into a competitive edge.

Don’t wait for Q4 earnings calls to wake up. The time to act is now.

Related Reading

- Decoding What CEOs Discuss – And What They Should

- When Tariff Wars End, Fishing Nets Will Beat Fishing Poles

- The Cost of Doing Nothing About Supply Chain Risk

Jim Tompkins, Chairman and founder of Tompkins Ventures and Tompkins Solutions, is an international authority on designing and implementing end-to-end supply chains. Over five decades, he has designed countless industrial facilities and supply chain solutions, enhancing the growth of numerous companies. Jim earned his B.S., M.S. and Ph.D. in Industrial Engineering from Purdue University.